FINANCE

Secure & engaging employee communications in finance

60% of financial institutions don’t have an internal comms strategy. Beat industry odds with ContactMonkey.

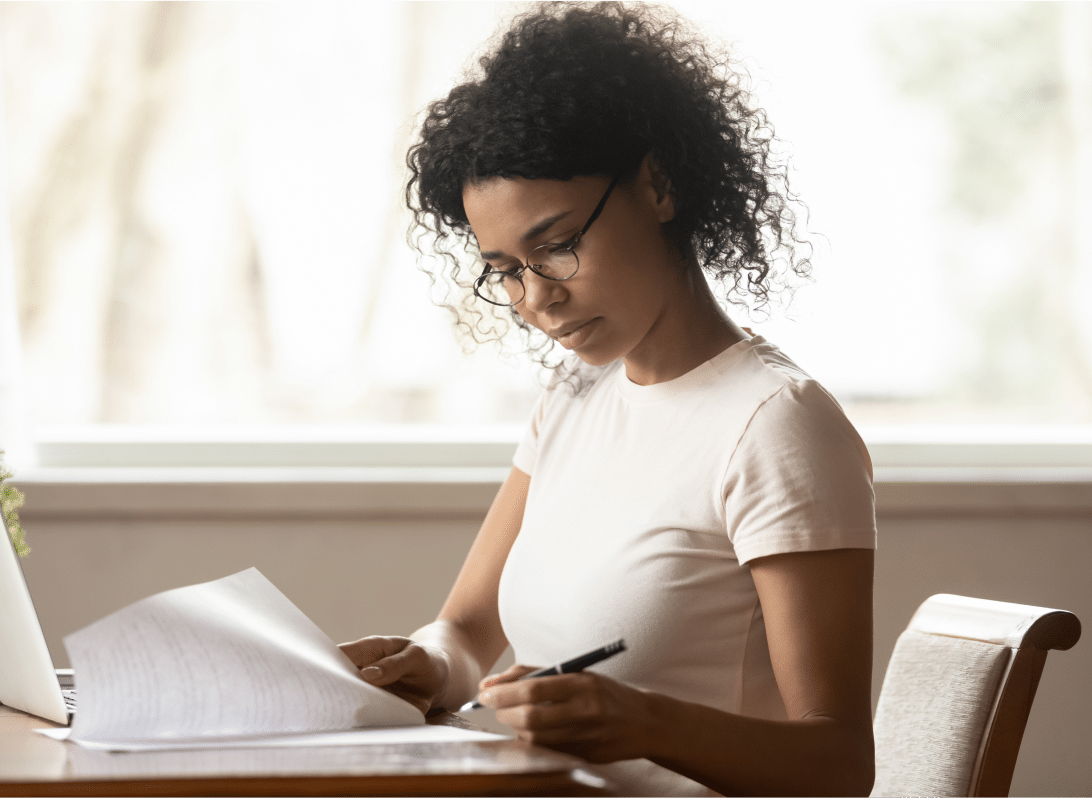

High employee turnover? Better comms make a difference

18%

of employees in banking and finance turnover year over year

53%

think about switching jobs within a year of joining

89%

employees are overwhelmed by email clutter

50%

miss crucial information during organizational changes

Mend employee disengagement in financial services, with ContactMonkey

Stay secure and compliant

Update employees on regulations and policies via encrypted file sharing and emails to reduce risk.

Learn moreReduce information overload

Craft engaging updates into preloaded email templates and seamless drag and drop.

Learn moreShare training and knowledge

Share product info, industry trends, and regulatory policies across departments and locations.

Learn moreMake informed decisions

Analyze employee engagement metrics and refine your future internal communications.

Learn moreAlways get your message across

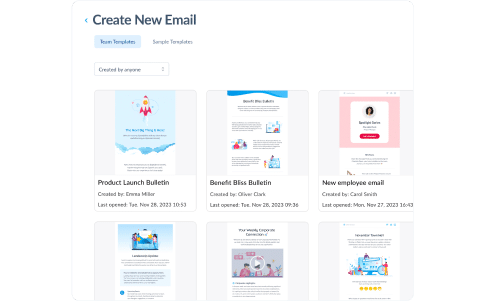

Share interactive key updates

Create clear and targeted newsletters from Outlook or Gmail, and sync with existing tools

- Choose from 700+ email templates that are easy to customize by drag and drop

- Segment your audience based on roles, departments, or locations

- Schedule messages at optimal times when your employees are most engaged

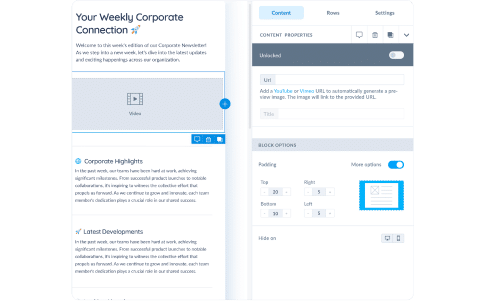

Streamline document sharing

Keep up with industry demands and close gaps across teams with real-time collaboration

- Attach documents easily in Outlook, Gmail, and Microsoft Teams

- Create, edit, and design important updates with multiple team members

- Auto-save changes in real-time and see version history to track revisions

Reduce compliance risk

Your data is protected. ContactMonkey is SOC 2 Type II certified and GDPR compliant

- Top-tier encryption protocols on AWS to secure all communication channels

- Monitor and track adherence to regulatory standards

- Reduce errors and violations within your financial institution

Shape your strategy with data

Never wonder what your people need. See engagement analytics and foster feedback

- Collect employee insights through two-way feedback surveys

- Monitor open rates, click-through rates, locations, and more in real time

- Assess employee satisfaction with interactive polls, quizzes, and buttons

Book a 15 minute call with one of our team members

Revive employee engagement with targeted, interactive emails and newsletters

Financial services communication FAQs

Secure internal communication is crucial in finance and can be achieved in various ways including through encryption services, compliance and regulations, secure messaging platforms and internal email software, employee training and awareness, regular security audits, and more.

Communication—and more specifically, internal communications—in financial services is vital for ensuring regulatory compliance, managing risks, fostering collaboration, and enhancing employee engagement.

Effective employee communications help build better internal understanding and builds customer trust. When organizations adopt technology that aids their internal communications strategy, they are better equipped to manage crises, align employees, and meet strategic goals.

Financial information can be effectively communicated internally across teams in a variety of ways, including but not limited to:

- Engaging newsletters: Create responsive newsletters tailored for financial updates, ensuring that complex information is presented in an engaging and digestible format.

- Real-time tracking and analytics: Use real-time tracking and analytics to monitor how employees engage with financial communications. This provides insights into open rates, click-through rates, and read times, allowing for data-driven improvements and individual follow-ups.

- Feedback surveys: Gather valuable input from employees using anonymous feedback surveys. Feedback mechanisms not only ensure that financial information is reaching its intended audience but also provides a channel for employees to express their ideas, concerns, and ask questions.

- Interactive elements: Enhance communication by incorporating interactive elements like polls, quizzes, and clickable buttons. This fosters active engagement and participation, making it more likely that employees stay informed and engaged with financial information.

Clear and effective communication, especially when facilitated by tools and an internal communication strategy, ensures compliance with regulatory changes, mitigates risks associated with misunderstandings, and encourages collaboration among different departments.

There are several challenges to employee communication in the finance sector, including but not limited to:

- Regulatory compliance: Because the industry operates in a highly regulated environment, this makes it challenging to communicate complex regulatory changes and compliance requirements effectively.

- Data sensitivity: Financial information is often sensitive and confidential. Communicating crucial details without compromising security is a constant challenge.

- Technological adaptation: The rapid evolution of financial technology requires continuous employee training and communication to keep teams updated on new tools and processes.

- Risk communication: Effectively communicating risk management strategies and procedures to employees is crucial to prevent errors that could lead to financial losses.

- Interdepartmental collaboration: Silos between different departments can hinder effective communication, leading to fragmented knowledge and collaboration within the organization.

- Comprehensive training: The complex nature of financial services requires comprehensive training programs. Ensuring that all employees have a thorough understanding of their roles and responsibilities is a persistent challenge.

Overcoming these challenges requires a strategic approach to internal communications. Leveraging internal email software like ContactMonkey can enhance clarity, transparency, and engagement among finance professionals.

Enhancing internal communications in the finance sector involves strategic approaches to overcome industry-specific challenges. Here are key strategies to improve communication within financial institutions:

- Internal communications platforms: Implement robust communication platforms like ContactMonkey to streamline messaging and content creation, track employee engagement, and ensure secure and compliant information sharing within the organization.

- Clear and consistent messaging: Develop clear and consistent messaging, especially when communicating complex financial information. Avoid jargon and ensure that messages are easily understood by employees at all levels.

- Compliance training: Conduct regular training sessions to keep employees in the know about regulatory changes and compliance requirements. This ensures that everyone is on the same page and understands their roles and responsibilities.

- Secure information sharing: Invest in secure communication channels to share sensitive financial information. Encrypt emails and documents to maintain confidentiality and protect against data breaches.

- Cross-departmental collaboration: Break down silos by encouraging collaboration between different departments. Foster a culture of open communication to share insights and best practices across the organization.

- Feedback mechanisms: Establish feedback mechanisms to allow employees to express concerns, provide suggestions, and ask questions. This two-way communication fosters a culture of transparency and inclusivity.

Technology can transform communication in the financial sector in several ways. ContactMonkey’s internal email software with drag-and-drop email templates and real-time email tracking features enhances the speed and effectiveness of communication between employees. It also offers collaboration features necessary to mobilize effective teamwork. Embracing technological advancements not only improves communication efficiency but also positions financial institutions to stay competitive in a dynamic industry.

“ContactMonkey’s Dynamic Content tool saves me hours. I no longer need to copy, paste, or duplicate emails—I can send one version to the whole company and track just that. It saves time, brain space, and prevents duplication errors.”

James Maiden

Sr. Internal Communication Specialist

“ContactMonkey makes it quick to create dynamic, engaging emails for our team. It was easy to implement and everyone who uses it picked it up really quickly.”

Jeff Genung

Sr. Director of Internal Communications

“ContactMonkey does the job extremely well; took almost no time to integrate, and is less expensive than competitors.”

Danielle T.

Director of Communications

“[ContactMonkey] really does allow our teams to be creative, but also provides the analytics to make sure we’re doing the right things.”

Jeremy Roberts

Sr. Manager of Communications, Go-To-Market & Incentives